This week, China was on the move for the country’s Spring Festival holiday, which kicks off straight after Lunar New Year. But while well-to-do Chinese are travelling again, they are staying much closer to home.

According to data from Global Blue and Bernstein, while Mainland Chinese shopping in Hong Kong was at 426 percent of 2019 levels in January, and spend in Japan was at 232 percent, Chinese spend in continental Europe is only at 80 percent of 2019 levels.

American spend in key European hubs, by contrast, has surged since the end of the pandemic reaching 290 percent compared to 2019.

To be sure, the majority of travel during China’s 40-day ‘Chunyun’ period has always been domestic, with trips to hometowns particularly popular. But as one indication of the shift, flights from Beijing to Sanya, the Chinese tropical beach destination and duty-free hub, over the Lunar New Year weekend were in such high demand that the cost of a ticket surpassed 10,000 yuan ($1,400), roughly the same as the price of a flight to Paris on the same dates.

“I was just in Paris in January. Nobody was at the tax refund area but usually there would be a line,” said Aroma Xie, the Shanghai-based director of the showroom Seiya Nakamura 2.24.

Long waits for visas are one barrier, especially when destinations like Singapore and Thailand have dropped visa requirements for Chinese visitors, further boosting Chinese tax-free spending in Asia, which according to Global Blue has already grown to nearly a third higher than what it was in 2019. Chinese footfall in Japan is still less than half of what it was pre-pandemic, according to Global Blue, but the country has seen a recent uptick of Chinese tourists too, and they are spending more. Thanks to a weak yen, they are buying more than twice as much as they did in 2019.

Meanwhile, Hong Kong is expected to welcome 1 million mainland Chinese visitors during the holiday, according to the city’s tourism board, about 80 to 85 percent from where it stood in 2019. Domestic hubs like Chongqing, Kunming and Guilin, which offer shopping and entertainment closer to home are also growing in appeal.

Then there’s the preference for shopping malls of the kind rarely found in Europe, especially amongst those travelling as multi-generational family units. “You’re all in the same place but you can each do your own thing at a mall. It’s not all about one person’s destination, it’s a family destination,” Xie explained.

Economic uncertainty, including high unemployment amongst young Chinese is yet another factor. It is younger shoppers who travel more independently and are best able to navigate European street-facing stores without the need for the comforts of a lounge and other mall amenities, that have taken the biggest hit financially. A generation who knew only prosperity has had to confront redundancies and salary cuts, even in sectors like technology, said Gary Bowerman, the director of Check-in Asia, a tourism research firm, and author of the book “The New Chinese Traveller.”

Strained politics and racial tensions after Covid-19 that led to an upswing in anti-Asian attacks are also part of the puzzle. “There is definitely a feeling of uncertainty about international travel after reading western press,” said Huishan Zhang, a Chinese designer based in London. And with videos circulating on social media of anti-Asian assailants hurling insults like “go back to China,” some Chinese have decided not to come in the first place.

France is the outlier in Europe, where according to Global Blue senior vice president Mathieu Grac, Chinese spend has now returned to 2019 levels. That’s a strong rebound compared to Italy which sits at just 64 percent and Spain at 81 percent compared to 2019. But Bernstein said it expects other European countries to catch up starting around mid-year.

China is also taking steps to boost travel flows between the regions. Last November, it waived visa requirements for citizens of five European countries: France, Germany, Italy, Spain and the Netherlands to visit China. Although the gesture was not fully reciprocated, it resulted in some goodwill measures. Germany stepped up the processing times of Chinese visas dramatically, according to Bernstein, and France announced a new kind of visa which allows Chinese who complete certain studies stay for up to five years.

This Week in Fashion

Fashion, Business and the Economy

Tod’s Group to go private in deal with L Catterton. The Della Valle family is set to retain majority ownership of the company with 54 percent of total share capital, while L Catterton would have 36 percent. L Catterton will pay €512 million ($552 million) or €43 per share for its stake in Tod’s. Following the news, Shares rose to €42.7 each.

EssilorLuxxotica margins were just below expectations. Adjusted operating margin for 2023 reached 16.5 percent at current exchange rates. The company said it expects adjusted operating profit as a percentage of revenue in the range of 19-20 percent between 2022 and 2026.

Shopify fends off Temu and Shein as sales narrowly beat estimates. Revenue for the period rose 24 percent to $2.1 billion, beating the $2.08 billion average analyst estimate. The results didn’t impress Wall Street; Shopify fell about 4 percent in US premarket trading.

Engaged Capital gains support of VF heirs to shake up the North Face owner. Engaged Capital, which has a 1.3 percent stake in VF, has won the support of descendants of founder John Barbey. The Barbey family wants two directors on VF’s 12-member board replaced, one of which has been named.

Nike to lay off 2 percent of workforce. The company said it would redirect the resources towards its most important categories and growth opportunities. “We are not currently performing at our best, and I ultimately hold myself and my leadership team accountable,” CEO John Donahoe wrote.

US Senator urges SEC to block Shein IPO unless China operating risk disclosed. Marco Rubio wrote that Shein’s recent decision to request approval from Beijing for a prospective US IPO “raises serious doubts” about the accuracy of the company’s filings. Opposition from Rubio is the latest political obstacle for Shein as it attempts to list publicly.

Aditya Birla fashion and retail records net loss in the third quarter. The Indian fashion conglomerate’s loss amounted to 108 crore rupees ($13 million) for the quarter ended Dece. 31. The company said bottom line performance was impacted due to “increased interest costs from higher borrowings.”

Target’s new private label brand to offer cosmetics and apparel with prices starting under $1. Prices of products such as apparel and cosmetics housed under the private-label brand, known as Dealworthy, will start from less than $1, with most under $10. The goods will arrive in stores and on Target.com this month.

US retail sales drop by most in nearly a year after the holidays. The value of retail purchases, unadjusted for inflation, decreased 0.8 percent from December after a downward revision to the prior month. The decline indicates that consumers took a breather after a strong holiday shopping season.

Climate group lodges greenwashing complaint against Lululemon in Canada. The organisation has asked the competition watchdog to investigate whether Lululemon’s “Be Planet” messaging misleads shoppers. There is no guarantee Canada’s Competition Bureau will pick up the case.

Tiger Woods debuts new lifestyle brand Sun Day Red. The golf legend’s new apparel and footwear brand is created by golf equipment company TaylorMade. The brand operates as a separate business unit based in San Clemente, Calif. under the leadership of president Brad Blankinship, the former general manager of Quiksilver.

Anna Wintour to host Biden fundraiser during Paris Fashion Week. Wintour will join Rufus Gifford, the finance chair for the Biden-Harris 2024 presidential campaign, to lead the event taking place at an undisclosed location on March 4 in Paris. Tickets start at $500 and go up to $10,000.

The Business of Beauty

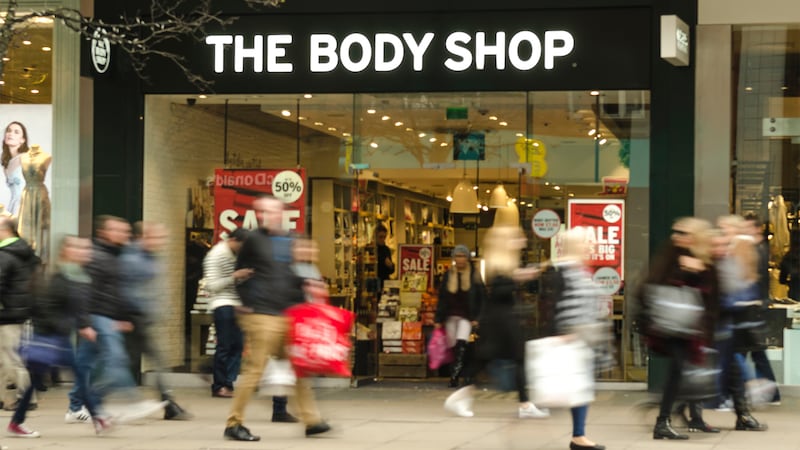

Job losses likely as The Body Shop lines up administrators. Trading over the festive period and early January were weak, according to Aurelius. The chain did not have enough working capital to continue trading in its current form.

China online beauty sales surge in January. Data from Bernstein indicates a market-wide recovery, once the impact of a protracted decline in duty-free beauty is stripped out. Online beauty sales last month surged by 58 percent year over year.

LeBron James to launch men’s grooming line. The Shop Men’s Grooming Line, developed in partnership with beauty manufacturer and distributor Parlux Ltd, will be stocked in around 1,600 Walmart stores. The line will launch in April.

Cult skincare brand Dieux makes Sephora debut. The label will launch in 714 physical stores in early March. To support the Sephora launch, the brand hired a head of retail, Lesley Yee Leung, and is scaling up production of products that frequently sell out.

Valentino to launch a high perfume range. L’Oréal revealed the line to press and buyers in Paris ahead of a late spring release. The range will be inspired by creative director Pierpaolo Piccioli’s couture shows which have sought to rejuvenate and recontextualise the brand’s top-end made-to-measure line.

Smashbox enlists Pamela Anderson in a comeback bid. Anderson was revealed as the face of the brand’s new “OG” campaign promoting its Photo Finish Primer hero product. With Anderson, the label is hoping to tap into nostalgia for its 1990s and 2000s heyday.

People

Farfetch CEO José Neves steps down amid executive shakeup. A cadre of other Farfech executives will also exit, including the company’s chief financial officer, chief product officer, chief platform officer, chief marketing officer and chief operations officer. Coupang’s CEO Bom Kim and a team of remaining Farfetch executives will helm the company in the meantime.

Alastair McKimm is leaving i-D magazine. The British style bible has suspended publication under new owner Karlie Kloss. The company will continue its restructuring without the leadership of the star stylist and fashion editor. A successor has not yet been named.

Media and Technology

Zendaya, Jennifer Lopez, Chris Hemsworth and Bad Bunny will co-chair Met Gala. The dress code for the gala is “The Garden of Time.” This year, TikTok will sponsor the event for the first time, as well as the LVMH-owned fashion label Loewe.

Temu spent millions on six Super Bowl ads as it tries to win back US shoppers. Observed sales fell 12.5 percent month-on-month in December and 4.8 percent in January, a sharp drop from the app’s growth of more than 50 percent in mid-2023. Shares of Temu’s parent company PDD Holdings Inc. have fallen nearly 10 percent this year.

NYC sues social media platforms over teen mental health concern. The city filed a lawsuit in California state court in Los Angeles against Meta, TikTok Inc. and its parent company, ByteDance Ltd.; and Google LLC and its YouTube platform. The city alleges that Meta Platforms and others exploit children and adolescents.

Hearst profit falls 2 percent due to declines in TV and print media. The company’s consumer media businesses, which account for half of the revenue, have confronted sluggish digital advertising sales and weaker ad revenue in a non-election year. CEO Steven Swartz said he expects 2024 to be a strong revenue year.

Compiled by Yola Mzizi.