Luo said she was not quite sure how to answer. “If there hadn’t been this [bill], I would definitely recommend them to do so in the US,” she said, adding that her business in the US is “certainly more profitable” than those in other markets.

Other cross-border merchants interviewed by the South China Morning Post are more certain. “It’s not the time for newcomers to enter the US,” said Hong Ming, co-founder of the Shenzhen-based TikTok Seller Alliance.

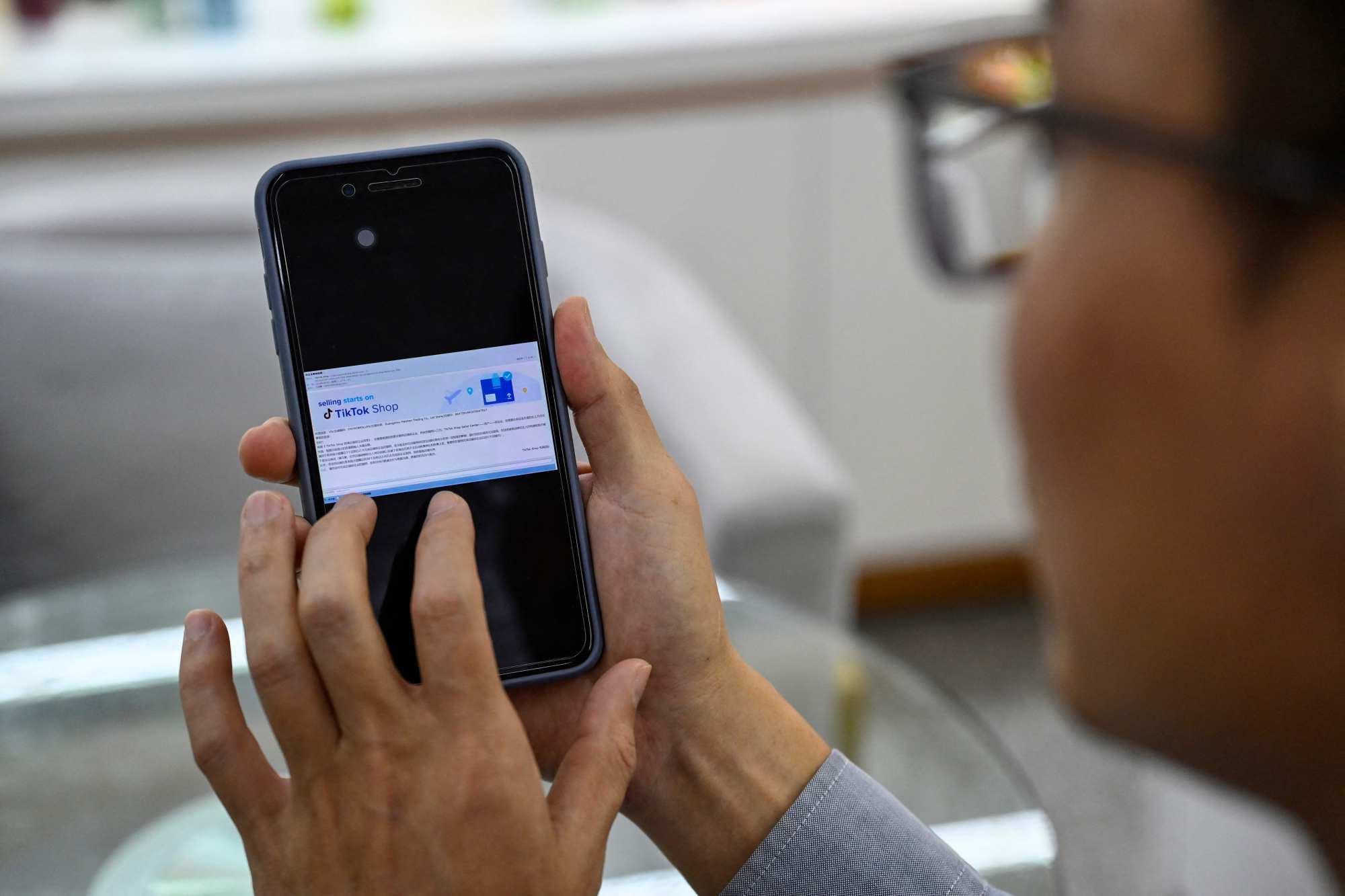

The “divest-or-ban” bill has thrown a spanner in the works of not just Chinese sellers planning to expand their business to TikTok, but also to the platform itself, which has been stepping up efforts to profit from its popularity among young Americans through e-commerce.

But the clock is ticking for TikTok: the platform now has until January 19 next year – one day before Biden’s term is set to expire – to fight to stay in the US, and ByteDance is not ready to give up on the first Chinese-owned app that has achieved worldwide popularity.

TikTok can afford to lose India but not the US, because many globally viral TikTok clips are created by American users, according to a person familiar with internal discussions at ByteDance.

A US exit for TikTok would also deal a blow to the ambitions of ByteDance’s billionaire founder Zhang Yiming, who launched the company in a residential flat in Beijing in 2012. Before he handed over the CEO and chairman positions to his co-founder and university roommate Liang Rubo in 2021, Zhang repeatedly spoke about his vision of a global operation based on TikTok.

That dream now appears increasingly remote amid growing rivalry between China and the US. While Beijing has been relatively restrained in its response towards the TikTok bill, the Chinese government has made it clear in the past that the powerful algorithms driving TikTok cannot be sold to American owners.

As uncertainty mounts, influencers have begun to take precautions.

“It will definitely be damaging to see [TikTok] go away,” said Noah Jay Wood, who has 7 million followers on the platform. He said TikTok has better algorithms. “Whenever something is trending, you will be informed [by TikTok], unlike the other platforms, which are always late to the game.”

While TikTok is the “foundation” on which he grows his content and following, Wood said he “recycles” all of his TikTok content for publishing on Instagram and YouTube, “which has led to me finding new audiences on them”.

It is “absolutely” critical for TikTok creators and merchants to diversify their presence regardless of a potential TikTok ban, said Alessandro Bogliari, co-founder and CEO of Miami-based agency, The Influencer Marketing Factory.

“It’s risky to rely solely on one platform due to the ever-changing algorithms that affect how creators reach their audience,” he said. What is more, if TikTok is banned, creators and merchants “could face financial difficulties while trying to establish new revenue streams”.

Despite its broad popularity, TikTok is under intense competitive pressure.

According to a report by market intelligence firm Sensor Tower in March, nearly 94 per cent of TikTok users in the US also browsed YouTube in the previous 90 days, while 80 per cent used Instagram and 68 per cent looked at Facebook.

“Google and Meta [Platforms] would be poised to seize advertiser demand for short-form video placements, given each has a viable short-form video alternative in Shorts and Reels, respectively,” said Abraham Yousef, senior insights analyst at Sensor Tower.

American shoppers already appear to be losing interest in TikTok.

Last month, the total value of goods sold on TikTok in the US amounted to just under US$419 million, which was lower than US$446 million in March, although still higher than February and the previous three months, according to EchoTik, an analytics and data provider focusing on TikTok.

Two weeks ago, ByteDance did a soft launch of TikTok Notes, a photo-posting app that directly competes against Instagram, in Canada and Australia.

Despite the cloudy outlook, the US is still one of the most important markets for cross-border merchants, as it remains a cultural trendsetter, and consumers there are more well-off, according to Wang Haizhou, founder of EchoTik.

“Once a brand becomes popular in the US, other markets will follow,” he said.

If TikTok does eventually quit the US, Hong from the TikTok Seller Alliance said he would use other platforms, even though his existing store powered by Shopify “can’t compare to the TikTok one in sales”.

Uebezz’s Luo said her next move would depend on the exact terms of the ban. If it was just a forced removal of TikTok from US app stores, she would still be able to reach American users who already had the app installed on their phones, she said.

For now, Uebezz maintains normal operations in the US, where many of the company’s goods are stored at a local warehouse waiting to be sold, Luo said.

Hong advised sellers to keep calm and carry on. “Just do whatever you can, and see how things develop before the 270-day deadline,” he said.