Kering shocked investors with a rare profit warning on March 19. Its once-darling brand, Gucci, which drives half of the group’s revenue, is expected to report a 20 percent YoY sales decline in the first quarter due to weak demand in China.

Upon the bleak news, Kering’s market value plunged by $9 billion, raising concerns about Gucci’s exposure in China and the country’s appetite for luxury.

This is interesting in light of a new report by RTG Consulting Group, which finds that Gucci is the most relevant luxury brand in Shanghai and the second most relevant brand across the Asia-Pacific region. In fact, a high percentage of consumers expressed their willingness to pay a price premium for Gucci.

RTG Consulting Group surveyed over 1,800 consumers across six key Asian fashion capitals — Shanghai, Hong Kong, Singapore, Jakarta, Bangkok, and Kuala Lumpur — to understand which luxury brands resonated with them across different stages of the consumer journey. Relevance was based on factors such as awareness, desirability, and willingness to pay.

Despite a rocky 2023 and an even rockier first quarter, Gucci’s brand equity remains strong in Asia. But is this enough to power its turnaround and push sales into positive territory?

It’s no surprise that when Chinese consumers were asked which luxury brand first came to mind, Gucci was right on their lips.

“Throughout its journey, Gucci has not shied away from making bold, strategic investments, always aiming to lead and innovate within the Chinese market, particularly in Shanghai,” says Marc-Olivier Arnold, Chief Strategy Officer, RTG Consulting Group. “And doing so while navigating cultural sensitivities without missteps, demonstrating a deep understanding of the local culture.”

Arnold gives the example of Gucci unveiling its inaugural flagship store in Shanghai in 2009, three years before Louis Vuitton did the same. He also points to the launch of its Shanghai Dragon Bag that year, which he describes as “a visionary move that left a lasting impression on the collective memory.”

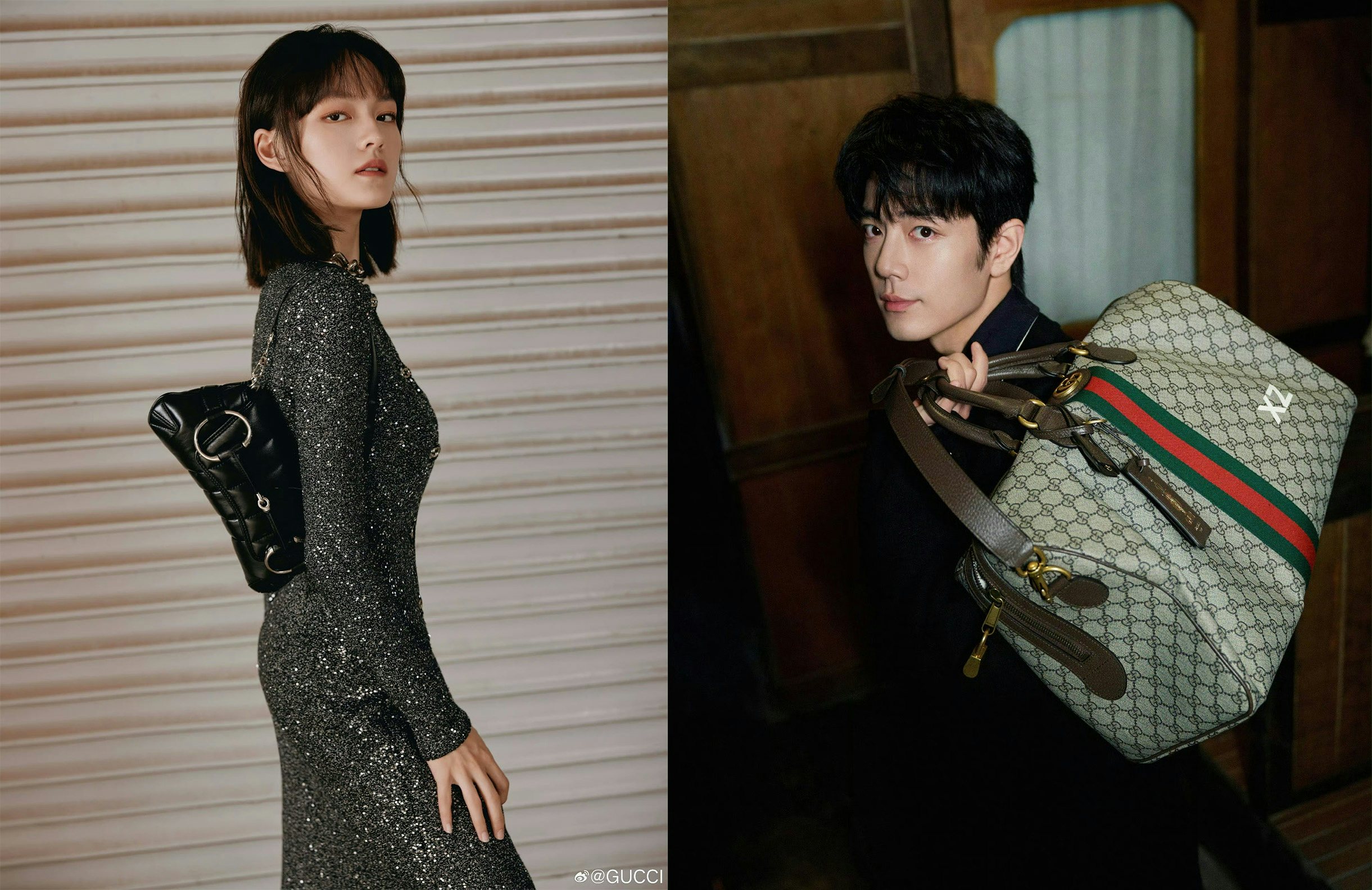

In addition to making a strong early impression, the Italian house has continued to dominate conversations in China by expanding its roster of celebrity ambassadors and filling its calendar with local activations.

“Cultural capital also stands as a pivotal factor behind Gucci’s status as the most relevant brand in Shanghai, particularly during Alessandro Michele’s tenure. The brand has adeptly positioned itself not merely as a luxury label, but as a symbol of cultural identity for the new generation,” Arnold adds.

Despite ranking highly in top-of-mind awareness, the Kering label doesn’t fare as well in terms of desirability, as evidenced by respondents’ preferences for the brands they desire to own (Chanel, Dior, and Louis Vuitton rank in the top three).

“The decline in desirability may signal a shift precipitated by the brand’s new creative direction, embracing a cleaner, minimalist aesthetic of quiet luxury — a notable pivot from the more creative, vibrant style that defined Gucci over the seven years preceding its change in creative leadership,” Arnold says, referring to the transition from Michele to Sabato De Sarno.

Although Gucci’s new ready-to-wear collections have been generally well-received, its leather goods have not been met with the same level of excitement, he continues. With the average luxury consumer gravitating towards bags over apparel, Gucci’s struggle to introduce a new must-have product may be dragging down its desirability with APAC shoppers.

Compare this performance to a brand that ranks highly in both awareness and desirability: Chanel. According to the RTG report, 34 percent of respondents spontaneously mentioned Chanel when asked to name a luxury fashion brand, and 44 percent expressed their desire to own a Chanel product.

One factor that elevates Chanel above the rest is its repertoire of iconic products.

“These pieces are not merely timeless; they are regarded as valuable investments, enhancing the brand’s desirability,” Arnold says, noting that the price of Chanel’s Classic Flap Bag (medium) surged 47 percent in China between 2019 and 2021 and then by 28 percent between 2021 and 2023.

Another factor is its balance between exclusivity and accessibility, says Sophie Coulon, managing director at VO2 Asia Pacific, a China-based digital and luxury consultancy.

“By operating only 18 stores across the country — compared to Hermès’ 33 — Chanel emphasizes the exclusivity of its luxury offerings. This strategy of exclusivity contrasts sharply with its approach to beauty products, which are widely accessible in physical stores,” she says.

This distinction is further underscored in Chanel’s digital approach, where it limits the availability of its luxury lines to its website and WeChat account while actively promoting its beauty line on major e-commerce sites and social media.

“This strategy not only emphasizes the exclusivity of Chanel’s luxury offerings but also leverages the extensive availability of its beauty products to build a young and loyal customer base, thereby increasing its visibility and desirability in China,” Coulon says.

When it comes to maintaining exclusivity, Gucci could take a page from Chanel’s playbook.

“[Gucci’s] merchandising and distribution strategy has been to maximize revenues rather than long-term desirability, so their products were easily available everywhere in big quantities; there hasn’t been any scarcity or waiting lists, which contribute to the exclusivity and desirability for the consumers,” a luxury marketing professional, who requested anonymity due to an NDA with Gucci, tells Jing Daily.

The marketing executive also echoes Arnold’s concerns about Gucci’s new creative direction, stating that the new brand image has not been an immediate success.

“It’s going to require years of balancing a stronger brand image and a strategic product distribution to try to increase the brand desirability again. With the current team it is going to be a very long and uncertain haul,” the marketer says.

Still, the RTG report optimistically suggests that “with the right positioning and marketing, a full turnaround of the Italian label is possible.” And it appears the Kering house is putting in the work with its Spring 2024 Ancora campaign in China, introducing consumers to its new bold red hue.

Although its rejuvenation journey has just begun, at least the brand has decades of Chinese love to lean on.