While global trade shows signs of weakening, the shipment of goods from China to Mexico continues to increase and is “probably the strongest growing trade in the world right now,” according to European data analytics firm Xeneta. Container demand for trade in this direction increased 59.7% in January compared to the same month in 2023.

Based in Oslo, the company claims to have the world’s largest market analysis and benchmarking platform for shipping and air freight rates. On Thursday, its chief analyst Peter Sand published a weekly report with the latest data. In it, he notes that demand for ocean shipping containers rose from 73,000 TEUs (Twenty Equivalent Units) in January 2023 to 117,000 TEUs in January of this year. “The strength in trade between China and Mexico has been building, with the annual growth rate in 2023 standing at 34.8% compared to just 3.5% in 2022,″ Sand says.

The numbers portray a rapidly changing picture. In recent years, the United States has imposed tariffs and restrictions on Chinese goods and services with the goal of encouraging companies to leave China and relocate in the U.S. or in an allied country. According to U.S. officials, they are pursuing that strategy for national security purposes. Mexico is emerging as an attractive alternative, as it is a middle-income country that pays wages comparable to those paid in China, is the southern neighbor of the world’s largest market and forms part of the world’s largest trading bloc: the United States-Mexico-Canada free trade agreement (USMCA).

For that reason, Sand discerns from the data a tendency for Chinese companies to triangulate their trade with the U.S. through Mexico to avoid tariffs. U.S. lawmakers and officials have complained that China is using Mexico as a back door to enter their market and have called on Mexico to comply with the rules of origin for products exported to the U.S., as set out in the USMCA.

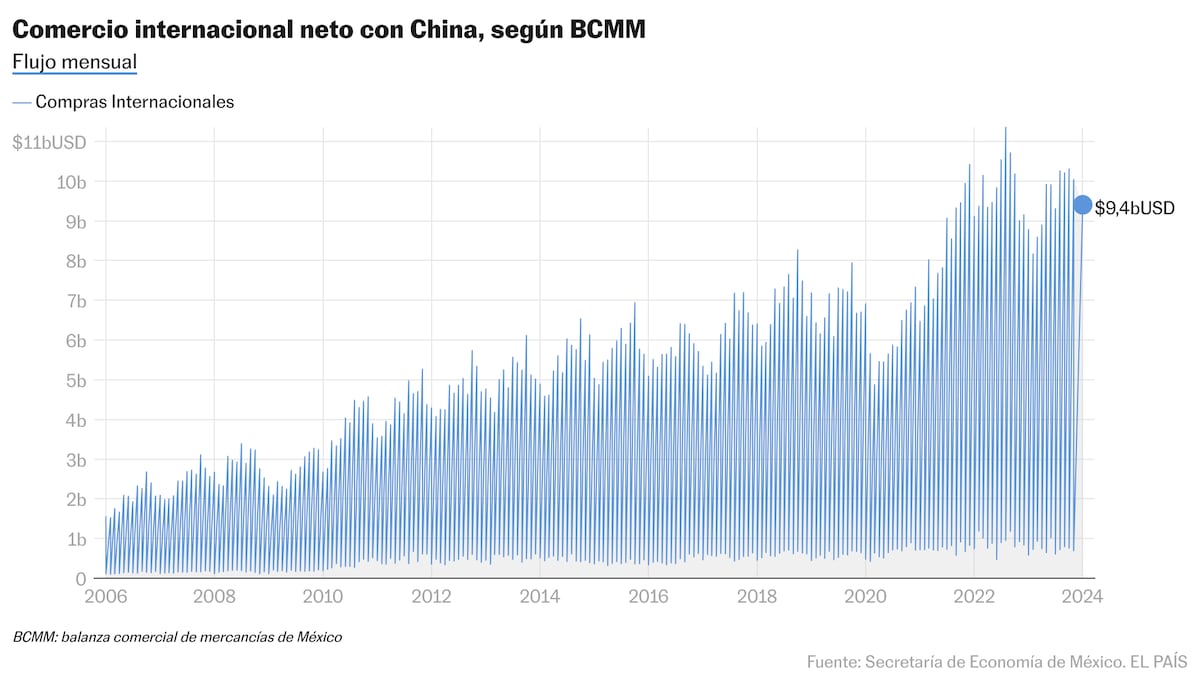

Trade deficit

Two days ago, the Confederation of Industrial Chambers (CONCAMIN) warned of a large deficit between Mexico and China. According to the organization, for every dollar Mexico exported to China in 2018, China sold Mexico $11.20; in 2023, for every dollar Mexico sent, China sent $11.40. Textiles and footwear are among the most affected sectors. For its part, China’s largest airline, China Southern, will launch its first direct flight to Mexico City, in a sign that business between the two countries is growing.

Last year, Mexico ranked as the top source country for imports into the U.S., dethroning China for the first time in 16 years. “However,” Sand wrote, “with a sizeable portion of these goods likely being trucked into the U.S., it gives rise to the possibility that China’s increase in trade with Mexico is being used to circumvent tariffs placed on imports from China to the U.S. as part of the ongoing trade war.”

In August of last year, Mexico amended its import tax law to place tariffs on products from countries with which it does not have a free trade agreement, including China. According to the Ministry of Economy, this was done to protect domestic industry. The change aligns with the messages the White House has been sending Mexico in recent years about its trade with “third countries” that are not part of the North American trading bloc.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition